In the dynamic world of forex trading, staying ahead of the curve is crucial. One strategy gaining significant traction is forex trade copying. This method offers an innovative way for traders to leverage the expertise of seasoned professionals without having to spend years honing their skills. Below, we’ll dive deep into the mechanics, benefits, and things to watch out for in this increasingly popular trading approach.

What is Forex Trade Copying?

At its core, forex trade copying involves replicating the trades of an experienced trader. This process is facilitated through platforms known as copy trading services, where novice traders can select from a roster of experts whose strategies align with their investment goals. Once chosen, the trades of these pros are automatically mirrored in the copier’s trading account.

How It Works

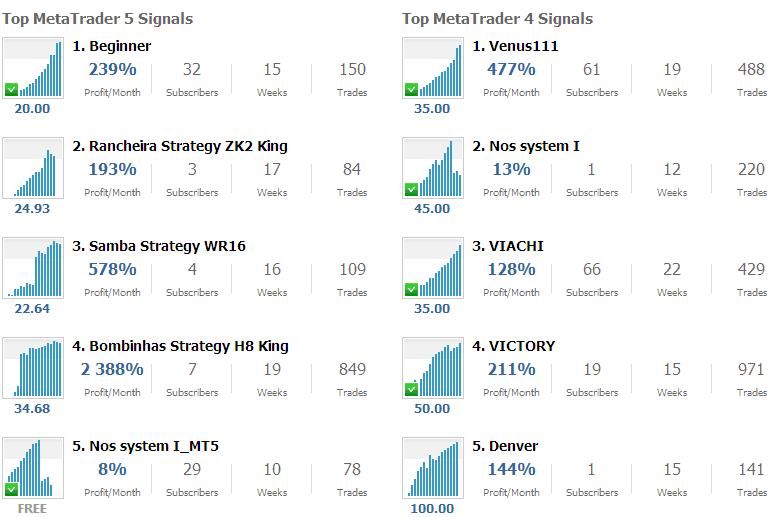

Forex trade copying platforms typically provide a list of master traders along with their performance statistics. Here’s a brief rundown of the steps involved:

- Sign up on a copy trading platform.

- Select a master trader based on past performance and risk profile.

- Allocate a portion of your investment capital to copy the selected trader’s moves.

- Automatically replicate the expert’s trades in your account, proportionate to your allocated capital.

Benefits of Forex Trade Copying

There are several key advantages to using forex trade copying as a trading strategy:

Accessibility

The main appeal is its accessibility. New traders who may not yet understand the intricacies of the forex market can participate and potentially profit by mirroring the actions of seasoned professionals.

Time-Saving

Rather than spending countless hours analyzing market trends and data, traders can let the experts take the reins. This allows for a more passive approach to investing, which is especially useful for those with other commitments.

Learning Opportunity

Read more about forex trade copying here.

By observing the strategies and decisions of experienced traders, newcomers can learn valuable lessons and develop their own trading acumen over time. This can serve as a practical educational tool in understanding market dynamics.

Potential Risks

Despite its benefits, forex trade copying does come with some risks:

Market Volatility

Even experienced traders are not immune to market fluctuations. Copying a trader’s actions does not guarantee profits; losses are equally possible, especially in volatile markets.

Blind Faith

Relying too heavily on another trader’s expertise might discourage individuals from conducting their own research and understanding the market. This can lead to a lack of personal growth and trading skills.

Fees and Costs

Copy trading platforms typically charge fees for their services, which can eat into your profits. It’s essential to understand the fee structure before committing to a platform or trader.

Choosing the Right Copy Trading Platform

Not all platforms are created equal, and the choice can significantly impact your forex trade copying experience. Consider the following when selecting a platform:

Reputation

Look for platforms with a strong reputation and positive user reviews. This can provide some assurance of reliability and performance.

Transparency

The platform should offer clear information about trader performance metrics, risk management, and fee structures. Transparency is key to making informed decisions.

Customer Support

Effective customer support is crucial for resolving any issues that may arise. Choose a platform with a dedicated and responsive support team.

In conclusion, forex trade copying opens new avenues for both novice and experienced traders, offering a blend of risk management, education, and potential profits. While it offers numerous benefits, it’s imperative to approach it with informed caution and a well-rounded strategy.